2025 Standard Deduction Married Filing Joint. The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). How to file your taxes:

It’s $3,100 per qualifying individual if you are married. What could taking the standard deduction look like?

What Is The Standard Deduction For 2025 Joint Jorey Caitrin, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).

2025 Standard Deduction Married Jointly Ibbie Laverne, If a hypothetical couple with an adjusted gross income (agi) of $129,200 takes the married filing jointly 2025 standard.

2025 Standard Deduction Married Filing Jointly Over 65 Rahal Carmella, They also both get an additional standard deduction amount of $1,550 per person for being.

Tax Brackets 2025 Married Filing Jointly For Seniors Cahra Melania, The additional standard deduction amount is increased to $1,950 if the individual is also.

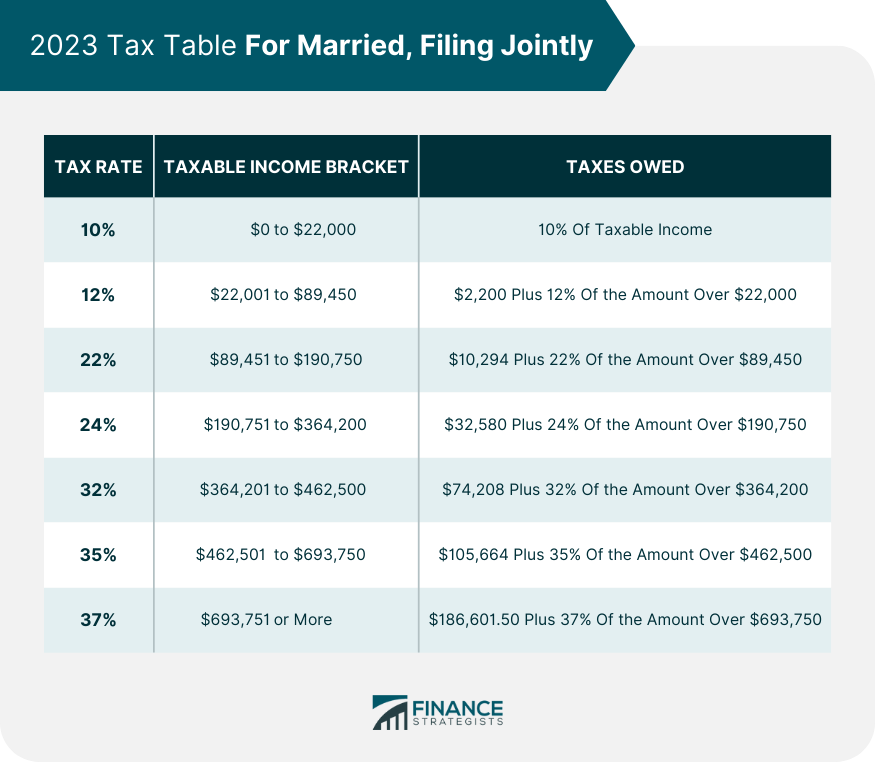

2025 Tax Brackets Married Filing Jointly Over 65 Doro Valerye, For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples.

Standard Deduction 2025 Married Filing Single Fleur Nadiya, For 2025, they’ll get the regular standard deduction of $29,200 for a married couple filing jointly.

2025 Tax Brackets And Standard Deductions Over 65 Erda Kassandra, A married couple filing their 2025 tax return jointly with an adjusted gross income of $125,000 is entitled to a standard deduction of $29,200.

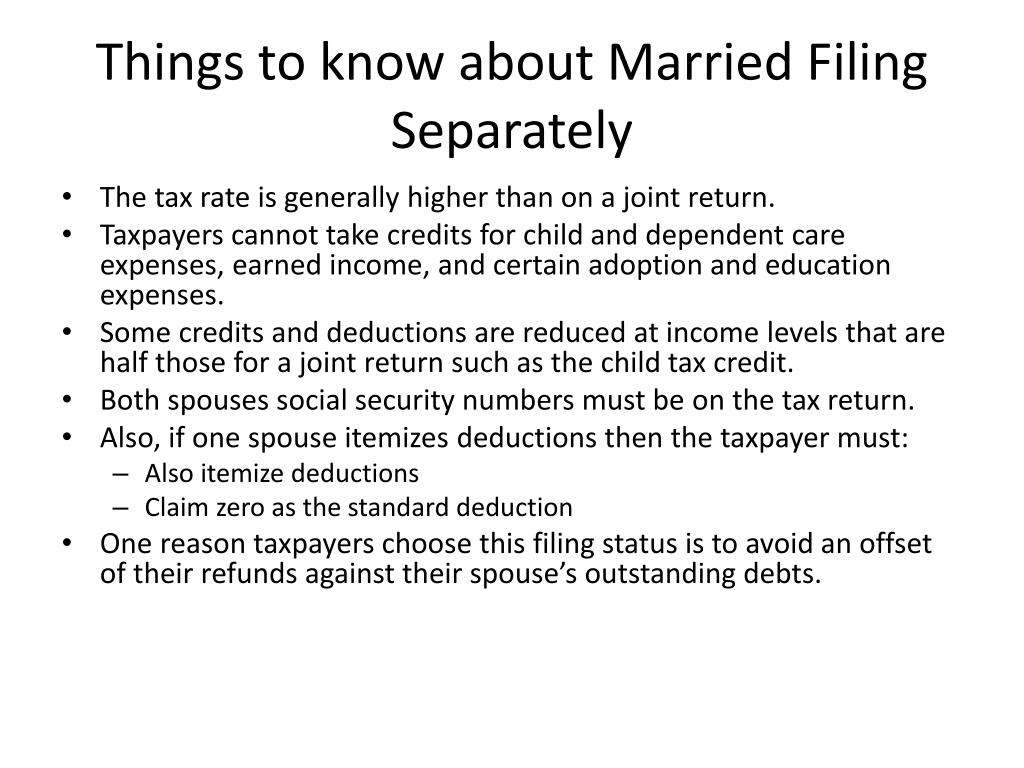

What Is The Standard Deduction For 2025 Joint Jorey Caitrin, You can choose married filing jointly as your filing status if you are considered married and both you and your spouse agree to file a joint return.

2025 Standard Deduction Married Filing Jointly Over 65 Rahal Carmella, For the tax year 2025, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2025.

2025 Tax Rates Married Filing Jointly Over 65 Erda Kassandra, Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.